Turkey is a large country located at the crossroads of Europe and Asia with a growing population of over 80 million people. As its economy expands Turkey’s demand for energy, particularly oil, has greatly increased. However, Turkey has very limited domestic oil reserves and production, making it heavily dependent on imported oil and refined petroleum products.

An Overview of Oil in Turkey

According to current estimates, Turkey only has around 600 million barrels of proven oil reserves. To put this into perspective, this is less than 1% of the global total. The country’s oil production is also very low, with around 3 million tons (approximately 60,000 barrels per day) extracted annually. This satisfies just 7% of Turkey’s oil consumption.

The vast majority of oil production occurs in southeastern provinces like Batman and Adıyaman, with smaller amounts in Thrace Most of Turkey’s crude oil is heavy, with an API gravity averaging 28° While suitable for the domestic market, heavy crude yields fewer high-value refined products like gasoline and jet fuel when processed.

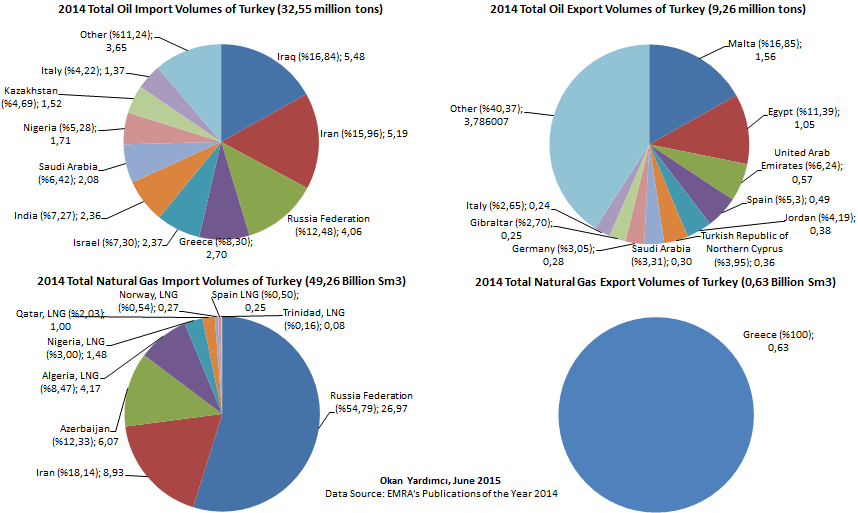

With such minimal reserves and production Turkey relies on imports for over 90% of its oil needs. In a typical year, the country brings in between 25-30 million tons of crude oil and refined petroleum products. The main suppliers are Russia and Iraq which together provide around 90% of these imports.

Why Turkey Has Limited Oil Resources

There are several key reasons why Turkey possesses few oil resources compared to neighbors like Iraq and Iran:

-

Geology: Turkey lacks major onshore oil basins with thick source rocks needed for oil formation. Areas with some potential like southeast Anatolia remain under-explored. Offshore areas in the Black Sea and Mediterranean have uncertain potential.

-

History: Turkey’s predecessor, the Ottoman Empire, once held oil-rich areas of Iraq. But these were lost following the empire’s breakup after World War I.

-

Exploration Efforts: Turkey’s national oil company TPAO drills 100-200 exploration wells annually but has made few major discoveries in recent decades. Attracting private investment faces challenges like permit delays.

-

Technology: Most oil production uses conventional techniques. More advanced methods like hydraulic fracturing and horizontal drilling are not widely deployed, limiting output from fields.

-

Political Barriers: Territorial disputes with other countries have prevented exploration in offshore zones like the eastern Mediterranean, where significant gas discoveries have been made.

The Impact of Oil Imports on Turkey’s Economy

With scant domestic oil resources, Turkey’s economy remains vulnerable to swings in global oil prices and supply disruptions. Oil imports account for a sizeable chunk of the country’s trade deficit. In 2021, Turkey spent $47 billion importing oil and gas, representing over 15% of total imports.

The economic effects of oil dependency include:

- Rising current account deficits when oil prices spike, weakening the Turkish Lira

- High inflation from energy costs being passed to consumers

- Increased budget deficits if oil subsidies rise to shield consumers from price hikes

- Greater exposure to supply risks, especially from major suppliers like Iraq and Russia

To reduce the strains caused by oil imports, Turkey aims to increase domestic production, diversify supply sources, expand biofuel output, and grow alternatives like renewable energy. But major change will take considerable time and investment.

Oil Production Efforts and Future Potential

Despite past disappointments, Turkey continues trying to expand domestic oil output by:

- Awarding more exploration acreage to TPAO and international firms

- Using enhanced oil recovery at mature fields like Batı Raman

- Developing additional finds like the 2023 Gabar heavy oil discovery

- Exploring Black Sea and Mediterranean offshore basins

- Investing in advanced technologies to unlock unconventional oil

Based on current knowledge, most analysts believe Turkey will remain heavily dependent on imports to satisfy rising oil demand. But if exploration efforts bear fruit or technological breakthroughs occur, the country could eventually produce 200,000-300,000 barrels per day.

While meaningful, this would still meet less than half of projected 2040 consumption. Ongoing work to diversify Turkey’s energy mix with natural gas, nuclear power, renewables and energy efficiency will likely be just as important for greater energy security.

Oil and Gas – Turkey Explore oil and gas export opportunities and the regulatory environment in Turkey. Tab Options

Turkey is a net importer of oil & gas with potential prospects in the Thrace basin, offshore Mediterranean and Black Sea. Turkey spends over $40 billion every year for the imports of energy resources such as oil, natural gas and coal. Local oil production meets only 7% of the demand, so Turkey imports approximately 260 million barrels of oil. Shale gas has not been widely explored. Although Turkey, with a population of over 80 million and approximately $800 billion GDP, is a major consumer of oil and gas, it is also an important transit country for natural gas produced in Azerbaijan and Russia with prospects from other countries in the region.

Other resources found in the Eastern Mediterranean and Iraq can be transported through pipelines from Turkey to Europe. Turkey intends to import compatible LNG rather than long term pipeline gas. Turkey imports approximately 45 bcma of natural gas every year. While in previous years pipeline gas was 80% of the gas imports and LNG was 20%, this changed to 73% and 27%, respectively, in 2019 due to the attractiveness of compatible LNG prices. The main importer of LNG is state-owned company BOTAS and other private firms also possess import licenses. However, unless the market is fully liberalized, these private sector importers will not be market players. Turkey has two LNG terminals and two FSRU facilities.

LNG is supplied from Algeria, Nigeria, the United States and Qatar as spot LNG. National oil and gas exploration and production company Turkish Petroleum (TP) conducts oil & gas explorations in Turkey and abroad either on its own or in joint ventures with other national and international companies. TP is a major buyer of upstream equipment for both onshore and offshore explorations. Other private sector producers operating in Turkey procure their own equipment usually from the U.S., China or European companies. Engagement with Botas for LNG and piped gas will be important in the first quarter of 2021 as several long-term piped gas agreements will expire.

The Turkish Government is focusing on offshore Mediterranean and Black Sea exploration and drilling. Therefore, upstream equipment and services can find a good market in Turkey. Three national offshore ships are currently conducting exploration and drilling in the Eastern-Med. Some local production of natural gas exists in the European Land of Turkey (Thrace) and oil production in southeastern Turkey. However, these amounts are minimal when compared with total demand for oil and gas. Much more oil and gas exploration is required since Turkey sits next to the oil and gas-rich Middle East. In the global context, Turkey’s total exploration is still at very low levels.

Russia’s long-term agreement to supply Turkey with 16 bcma will expire in 2021, which will allow Turkish national pipeline company Botas to seek other competitive suppliers. Later, the long-term agreement with Iran to supply 9.6 bcma will expire in 2025. Therefore, competitive pipeline and LNG supplies will find a good market in Turkey. Botas has been gradually decreasing subsidization of natural gas prices, resulting in higher gas prices on the local market, in particular for gas sold to power plants. Consequently, the majority of privately-owned gas-fired power plants have ceased operations temporarily. Low electricity prices made possible by cheap hydro power generation and over-capacity have also contributed to this trend. With a liberalized gas market and economic growth in a few years, demand from power generation may increase. In southeastern Turkey, some prospects exist, and some production and new discoveries are occurring. In the Thrace Basin, there are additional exploration opportunities. Methanol produced from natural gas can find a good market in Turkey as Turkey is a major methanol importer.

Turkey, with pipeline connections with Russia, Iran, and Azerbaijan, additionally with two LNG import terminals and two FSRU facilities, has a very competitive environment. Therefore, entering into the market requires competitive prices in comparison to pipeline gas prices, which is currently indexed to oil prices. Energy Market Regulatory Authority (EMRA) passed a regulation this year that spot gas delivery through pipelines will also be possible. Turkish Government prefers spot NG or LNG to avoid the risk of take or pay long term contracts as the consumption is unpredictable nowadays. Another reason for this trend is to establish a competitive gas exchange market through the Spot Natural Gas Market established at the Turkish Energy Exchange of Istanbul (EXIST) (https://www.epias.com.tr/en/spot-natural-gas-market).

Turkey – Oil and Gas

Take advantage of our market research to plan your expansion into the Turkish oil & gas market. This guide includes information on:

- Current market needs,

- The competitive landscape,

- Best prospects for U.S. exporters,

- Market entry strategies,

- The regulatory environment,

- Technical barriers to trade, and more.

Get Industry Updates

Türkiye discovers oil reserves in east

FAQ

Is Turkey an oil rich country?

How much oil comes from Turkey?

Does Turkey have oil and natural gas reserves?

Is Turkey an oil exporting country?

Does Turkey need oil & gas?

Still, fossil fuels continue to drive Turkey’s economy, with a heavy dependency on imports, especially oil and gas (93% and 99%, respectively). Turkey has prioritised an expansion of domestic exploration and production to help reduce its oil and gas import dependency.

What are the health benefits of ground turkey?

Ground turkey has multiple benefits. It is a good source of minerals, and B vitamins, rich in proteins, low in fat and it is lower in calories than common turkey.

How much oil does Turkey use a year?

Total Oil Reserves in Turkey are less than even a single year of oil consumption (343,779,139 barrels as of 2016), making Turkey highly dependent on oil imports in order to substain its consumption levels. Global Rank: 53rd | Share of World: 0.02 % See also: List of countries by Oil Consumption

Does Turkey still buy oil from Russia?

Unlike several European countries, which stopped buying oil and gas from Russia or were cut off after the 2022 Russian invasion of Ukraine, relations with Russia are such Turkey continues to buy both commodities from Russia.